The global fund information platform Citywire is a new business member of Fondsfrauen and reports, among other things, on gender diversity in fund management.

Every year since 2016, Citywire has published the Alpha Female Report, which analyses global progress in the area of "women in fund management". The result is the same every year: the proportion of women is far too low. Germany in particular has some catching up to do and is one of the laggards both in Europe and worldwide. Asian countries such as Taiwan and Hong Kong are setting the pace.

In Germany, the proportion of female fund managers has not increased significantly since 2016

In 2023, the Citywire database comprised 18,015 active fund managers worldwide. Only 12.1% or 2,179 of these are female. In Germany, the ratio is even worse: out of 650 fund managers, only 7% are female. This result is just enough for 21st place out of 24 in the global ranking, which includes all countries with 100 or more fund managers.

Switzerland also performs poorly in an international comparison, with a share of women of just 9%. However, this at least puts the country in 17th place, with only Austria doing better in the DACH region. In the global ranking, the country is right in the middle with a female quota of 11%.

Little progress since 2016

Little progress since 2016

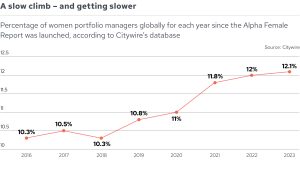

This year's result of the Alpha Female Report is not particularly surprising if you look at the development of recent years. From 2016 to today, the global share of female fund managers has only differed by 1.8 percentage points. In Germany, the proportion has actually only increased by one percentage point in eight years. In Switzerland, at least a little more has happened and there has been an increase of 4 percentage points. In Austria, on the other hand, the number of female fund managers has shrunk since 2016: back then it was 13% - now it is 11%.

Given such figures, it is hardly surprising that funds managed by women are in the minority. Of the 28,542 actively managed funds worldwide, only 1,490 were managed by a woman this year. This number has steadily decreased in recent years.

Growth in mixed management teams

In contrast, there was an increase in the number of mixed teams. Their number almost doubled globally between 2016 and 2023. In Switzerland, too, there are twice as many mixed-gender management teams in 2023 as there were in 2016. In Germany, the number has almost tripled, and in Austria there are now almost five times as many mixed teams as there were eight years ago.

Asia is far ahead

Taiwan, among others, shows that the path to gender parity can also be better. The Asian country is a global leader in gender equality in fund management and has achieved a female quota of 29%. No country has achieved such a high ratio since 2016. In 2021, Hong Kong came very close to this result with a share of 28% and was in first place at the time. This year, however, the proportion of women in Hong Kong has fallen.

In Europe, the South in particular stands out positively when it comes to equality: Spain is among the top 3 worldwide with a 21% share of women. In 2016, the country even led the global ranking with a share of 27%.

Individual European companies also stand out positively. CaixaBank Asset Management Luxembourg, for example, is ranked # 1 this year among companies with 50 to 100 managers. In 2021, it even almost achieved gender parity.

In terms of the employment of female fund managers, DWS is the leader among the three largest asset managers in Germany: 15% of its 54 managers are female. Allianz Global Investors follows with a difference of just one percentage point. Union Investment is in third place with a female share of 6%. The global leader is J.P. Morgan Asset Management.

Something is happening, but development is taking time

Not everything is going badly, but a lot needs to improve - especially in Germany. With a quota of 7% female fund managers, we are still a long way from achieving gender parity in fund management. However, this should not discourage us, but rather motivate us to drive forward the advancement of women in the industry. Many have also recognised this need, as evidenced by the high number of new in-house and regional networks that support women in the financial sector.

In 2023, the women's network FAM - Women in Asset Management was founded in Austria and the Association of Independent Asset Managers (VuV) organised its first event specifically for women in June. Petra Ahrens, Chairwoman of the VuV, founded a financial advisory service for women in 2022. In addition to the newly founded organisations, there are also a number of established networks that have been promoting gender diversity for years - the best-known being the "Fondsfrauen" active in the DACH region. Each of these organisations shows that something is happening, but also confirms that there is still a great need for support.

Text: Jana Rudolf, Citywire