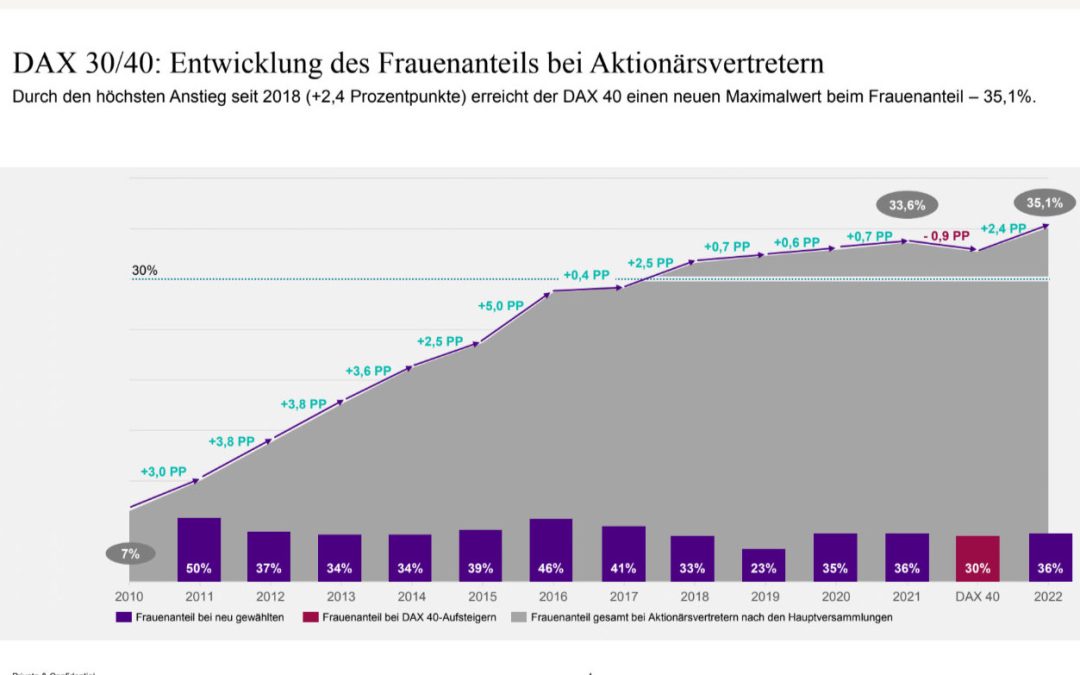

- The proportion of women on the supervisory boards of DAX 40 companies reaches a new all-time high of 35.1% (shareholder representatives)

- Internationality also reaches all-time high: 36% of DAX supervisory board members not from Germany

- Number of supervisory boards with sustainability committee has tripled

- Less interlinking: number of multiple mandates smaller than ever before

- More dynamic: new terms shorter than ever before, averaging 3.2 years

- Less co-determination: number of supervisory boards with equal representation at an all-time low

The supervisory boards of Germany's 40 largest listed companies are more diverse than ever before: The proportion of women in the DAX 40 has reached a new historic high of 35.1% (shareholder representative side). It is the highest increase within one year (+2.4 percentage points) since 2018. If the female employee representatives are included, the proportion has risen to a current 37.1%. This shows the annual analysis of DAX supervisory boards by the human resources consultancy Russell Reynolds Associates, which deals with the staffing of supervisory boards, among other things.

The DAX has thus more than made up for the decline in the proportion of women on supervisory boards following the increase to 40 companies last year. Seven of the 40 companies now have 50% women or more on their supervisory boards (previous year: three). At a further nine companies the proportion of women is 40% or more. With Porsche, Siemens Healthineers and Linde, only three companies remain below the required level of 30%. But not only is the proportion of women on the DAX at an all-time high, German supervisory boards are also more international than ever before: 36% of the members of the DAX 40 supervisory boards come from abroad.

There has also been some movement in the distribution of power within the supervisory boards: For the first time, 10% of supervisory board chairmen are female. And 17% of the committees are now chaired by women (previous year: 13%); both are new highs.

Diversity continues downstream

"The sometimes arduous social debate about more diversity and equality in companies has paid off and is bearing fruit: DAX supervisory boards are more diverse than ever before, and the trend toward more diversity continues. Gradually, the signal and role model function of the supervisory boards is becoming apparent for top management, where the development toward more diversity is also progressing and continuing at the management levels below. The supervisory and management culture in DAX companies is undergoing its most profound transformation to date. Despite all the challenges in implementation, the supervisory bodies and boards will ultimately emerge stronger," says Jens-Thomas Pietralla, head of the European Board Practice at Russell Reynolds Associates.

The increasing diversity on supervisory boards is also beginning to have a significant impact for the first time at management levels 1 and 2 below the executive boards. There, the proportion of women has risen by five and three percentage points respectively within a year, the highest increase in five years.

Source: Russell Reynolds

Supervisory boards must perform quickly today

At the same time, DAX supervisory boards are more permeable, more dynamic and less intertwined. The proportion of supervisory board members with multiple mandates (previously a typical feature of the so-called Deutschland AG) has reached its lowest level ever at 10%. In addition, the terms of office for which the new supervisory boards were elected this year are, at an average of 3.2 years, around a quarter shorter than the long-term average and thus shorter than ever before. "Shorter terms allow supervisory boards to be reconstituted more quickly and operate more agilely," says Dr. Thomas Tomkos, head of the German Board Practice at Russell Reynolds Associates. "Companies need to respond to change at increasingly shorter intervals. The requirements for effective oversight are also changing faster and faster. And sustainability expertise is more in demand than ever. Supervisory boards are now increasingly taking this into account: multiple mandates are declining sharply. Supervisory boards need to make an impact quickly. And they must be able to think sustainability from the outset, or anchor it in committees," says Thomas Tomkos.

Sustainability now firmly anchored

Sustainability has taken on a new dimension in its importance on DAX supervisory boards over the past year: The number of supervisory boards with an environmental, social and governance (ESG) committee has tripled compared to the previous year; one third of DAX companies now have an ESG committee. In addition, 15 of the 40 DAX companies (37%) have a supervisory board member with proven expertise in sustainability on board, 87% of whom are female.

Equal co-determination decreases

In terms of employee representation on supervisory boards, the trend toward less parity-based codetermination continues: The number of DAX companies with parity-based supervisory boards remains at the previous year's low. Currently, 70% of supervisory boards still have equal representation (28 out of 40). In 2015, the figure was almost 100% (29 of the then 30 DAX companies).