The inflows into and outflows from ETFs are a good indicator of investor sentiment. That is the reason why they are analysed regularly. Sophia Wurm comments on the movements in the European ETF market in the month just ended, July 2023. She is Vice President SPDR ETFs at State Street Global Advisors.

ETFs see total net inflows of US $ 17.2 billion

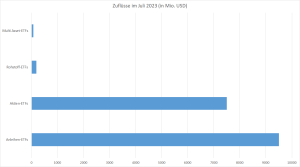

"In July, the European ETF market again enjoyed very strong demand. In total, net inflows of US$ 17.2 billion were recorded, with the bulk this time coming from the bond sector. More than US$ 9.5 billion in new money was invested here, while equity ETFs came in at US$ 7.5 billion. The gap between the two asset classes widened significantly from the middle of the month onwards," explains Sophia Wurm.

Bond ETFs enjoy particularly high demand

In the context of decisive central bank meetings of the Fed, ECB, BoE and other central banks, such as the Bank of Japan, government bonds (+4.3 billion USD), corporate bonds (+2.0 billion USD) as well as strategies with particularly short maturities (+1.8 billion USD) were in high demand. "In addition to classic investment-grade corporate bonds, bonds in the high-yield segment also enjoyed high demand in July (USD 750 million) due to the positive underlying sentiment on the international financial markets. There were only moderate outflows for bonds with inflation protection," comments Wurm.

Equity markets benefit from technology and AI hopes

The stock markets continued to benefit in July from the hype surrounding technical innovations and productivity increases with the help of artificial intelligence. At the same time, some economic data, particularly in the US, was less poor than expected or feared. "Against this background, it is not surprising that the rising equity markets - S&P 500 and DAX with new all-time highs - were accompanied by inflows into ETFs. ETFs on US equities were particularly popular (+4.3 billion USD). However, in addition to the S&P 500 standard stock index, investments were also made in medium-sized companies such as the S&P 400 and the S&P 600 Small Cap," says Wurm.

Investors dump bank and telecom providers

In terms of sectors, energy stocks also recorded inflows for the first time again after months of outflows and strategic underweights in many portfolios. "ETFs with a focus on US energy stocks benefited from this trend with inflows of around 250 million US dollars. On the losing side were European banks and telecommunications providers," Wurm points to the sectors with particularly high inflows and outflows.