The corona pandemic has shaken up our lives and brought about a lot of changes. Among other things, it has also changed the investment behavior of women towards more equity investments. In addition, the issue of sustainability has also contributed to persuading even stubborn savings account savers to invest in equity funds. That is the result of the study "Women and Investments - Planning for the Future", which J.P. Morgan Asset Management commissioned and published in May 2021. Around 4,000 women in 10 European countries were asked about their investment behavior. J.P. Morgan AM wanted to see what changes had taken place since the last survey in 2019.

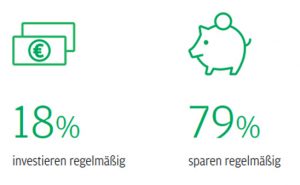

The good news is that 64% of the women surveyed now have experience in the capital market as investors. In Germany and Austria, the proportion of female investors, at 71%, is even leading across all the countries examined. However, although the persistently low interest rates have for years contributed to the fact that the achievement of long-term financial goals purely with savings deposits is becoming increasingly unattainable, too many women (79%) still rely on savings accounts and overnight money. In other words, not even one in five women (18%) invests regularly. And even female investors decide more often to top up their savings (37%) instead of their investments (29%).

Women would like to invest small amounts on a regular basis

Significantly, when asked what might induce them to invest in the capital market, a third of women savers answered that they would like to invest small amounts on a regular basis. This indicates that they are looking for an investment product that works more like a savings product, ”emphasizes Pia Bradtmöller, Head of Marketing & PR for Germany and Austria at J.P. Morgan Asset Management. (Photo).

But investing in securities not only helps to grow wealth. As the survey found, investing also increases financial self-confidence and even self-esteem: This is higher for over a third of women who invest than for women who have not yet invested. “Many studies confirm a close connection between financial security and general well-being. Financial planning can play an important role in this. In our survey, we found that over three quarters of women who invest have financial planning. Over half of the women who do not invest, however, do not have such a plan for their financial goals either. So it is not surprising that a high proportion of investing women are more confident about their financial future, ”says Pia Bradtmöller. Preparing a financial plan seems to be an important first step on the way to investing in the capital market.

The environment has priority among sustainability issues

The survey also shows which topic could be a driving force in increasing the often still lacking acceptance of securities investment: The survey results indicate that sustainable investing, which is generally seen as an important means for positive change, can play a key role.

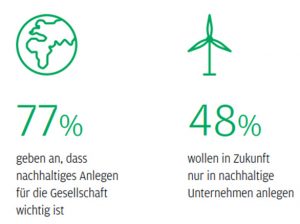

Three quarters of the women surveyed (72%) say that sustainable investing is very important. For 20% it is even of "extremely high" importance. Among women with previous knowledge of sustainable investments, more than three quarters (77%) are of the opinion that their investments do something good for society. Almost half (48%) see sustainable securities investments as the future of investing and assume that they will only invest in sustainable companies.

The survey also reveals which areas of sustainability are most in focus, with climate change being rated as the top priority by 65% of women surveyed. Human rights are an important issue for 49%, environmental pollution for 48% - with women from Germany and Austria at 65% finding this above average.

Despite the high level of interest in sustainable investments, only a quarter of the investors surveyed feel well informed about the topic. In addition, almost half of all respondents (49%) expressed concerns that a sustainable investment strategy would limit their investment choices. “This indicates that further information and good advice are important in order to translate women's interest in sustainable investments into action,” emphasizes Pia Bradtmöller.

Women in Germany and Austria could invest another 39 billion euros

Overall, the study shows that the pandemic has increased women's awareness of the need to plan for future uncertainties. “Emergency planning” is cited most frequently as the main reason for saving, followed by “saving for retirement”. However, many respondents prefer to use savings accounts instead of securities investments. The main reasons not to invest are the perceived complexity (65%) and the fluctuations (35%) of the capital market, which leads to a feeling of lack of control - especially in comparison to the flexibility and easy availability of savings books and overnight money accounts.

However, the survey identified a lot of potential for the women surveyed to invest more in the future. On the one hand, almost a third of female investors want to top up their invested amounts in the coming year. There are also savers who could imagine investing in securities. According to the survey, they would invest almost a third of their savings - especially if they could invest small amounts on a regular basis.

“We looked at the average amounts that women are currently saving and investing in each of the countries surveyed. On this basis, the amount for savers who are considering an investment was determined, as well as the value for investors who want to top up their investments. These numbers were extrapolated to the population of these groups to determine the total future growth opportunities for capital market investments for each country. Across all ten countries examined, this results in an investment potential of 177 billion euros and for Germany and Austria alone a potential of 39 billion euros, ”Pia Bradtmöller notes. This amount represents an interesting potential for asset managers and fund providers.

In order for women to unlock this potential and go from saving to investing, it is important to understand that investing in the long term is not much different than saving, but can deliver better results over time. It is also important to convey that securities investments do not mean the rigid corset that many fear. "Better communication about how portfolios can adapt to changing living conditions and capital market environments is necessary," says Pia Bradtmöller. Clear and easily understandable information about investment products is essential for this. "We have been working closely with our business partners on this for years and, as part of our 'From saving to investing' campaign and the Market Insights program, provide easy-to-understand information to convey the basics of long-term successful investing", adds Christoph Bergweiler, CEO JP Morgan Asset Management Europe S.à.r.l. He wants to intensify these efforts even further this year on the basis of the current findings.

About the study "Women and Investments - Planning for the Future"

The survey was carried out by the research house Kantar in ten European countries. In addition to Germany and Austria, which were considered together, women in Great Britain, Finland, France, Italy, Portugal / Spain (also combined), Sweden and Switzerland were surveyed. The field work was carried out in January 2021 by panel partners from Kantar using an online self-assessment questionnaire. Each interview lasted 20 minutes. A total of 3,968 interviews were carried out with women between the ages of 30 and 60, with half of the respondents in the 30 to 45 age group and half in the 46 to 60 age group. The participants have capital investments or savings and have a personal minimum income (varies depending on the country). In addition, a similar sample of men between the ages of 30 and 45 was interviewed to serve as a benchmark for comparison with the younger age group.

Foto von Pia Bradtmöller: Joppen