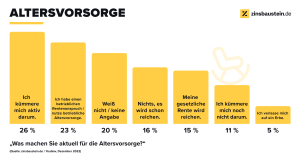

In Germany, hardly anyone believes that the statutory pension alone is sufficient for old age, and this will not be much different in other European countries. Nevertheless, only a few people actively take care of their financial security in old age. This is the result of a current representative survey conducted by YouGov on behalf of zinsbaustein.de, for which 2,000 people in Germany were interviewed in December 2022.

Only 15% believe that the state pension is enough

This shows that people in Germany have few illusions about the value of the statutory pension: Only 15 % of those surveyed believe that the statutory pension will suffice as old-age provision. After all, 23 % use a company pension scheme. Only 26 % state that they actively take care of their old-age provision. Five percent rely on a later inheritance.

A look at gender differences shows that women are less likely than men to actively take care of old-age provision (women: 23 %, men: 29 %). In fact, only 13 % of women (men: 16 %) assume that their statutory pension will be sufficient. "The barrier to doing something actively for old-age provision is particularly high among women. More than with men, a lack of financial means is probably a major cause here, because less income is available due to parental leave, the gender pay gap and more part-time and mini-jobs," explains Volker Wohlfarth, Managing Partner of zinsbaustein.de.

If one looks at the age groups, differences also become clear: Above all, 25 to 34 year-olds actively take care of the topic of old-age provision more often than the average of the Germans surveyed (34 %; average: 26 %). Among younger age groups, only eight to nine percent assume that the statutory pension will be sufficient; in old age, confidence increases somewhat: 23 % of those over 55 say that the statutory pension will be sufficient. Conversely, this means that three quarters of those who will retire in the next few years are also not convinced that the state pension will be sufficient. In this age group, however, only 20% say that they are actively looking after their old-age provision.

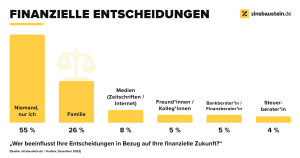

Germans prefer to be self-deciders when it comes to finances

It is also interesting to see how people inform themselves. Only 5 % of those surveyed take advice from bank and financial advisors. More than half decide on their own financial future. Family members are the most likely to be asked for advice. "When it comes to their finances, Germans prefer to make their own decisions. But although they are aware that they have to actively do something for their old-age provision, they do not act enough," Wohlfarth comments.

When it comes to their financial future, Germans prefer to rely on themselves: 55% of those surveyed agreed that they alone decide on this. They are followed at a distance by family members such as partners, siblings and parents (26%). Significantly fewer - eight percent of respondents - let themselves be influenced by information from the media with regard to their financial future. Bank or financial advisors play an even smaller role, with only five per cent of respondents consulting them when making financial decisions about their pension.

What is striking about the gender differences is that women make decisions about their financial future somewhat more often with themselves than men (59% women, 51% men). Men in turn rely more often than women on talking to friends or colleagues, on information from the media and advice from bank or financial advisors.

There is a very clear difference between the age groups when it comes to deciding alone about one's financial future: only 27% of 18-24 year-olds decide alone, compared to 66% of those over 55. In general, it can be seen from the survey results that up to the age of mid-40s, fewer people make decisions about their own financial future alone than over the age of 45. Family, friends and colleagues as well as information from the media are consulted more often by the younger age groups than by those over 45.

"In the future, smart financial technologies could become increasingly relevant in helping people keep track of their pension entitlement, savings rate and assets, and address the necessary topic of old-age provision at an early stage. Transparent information, good service and more exchange are also important," Wohlfarth adds.

"Digital pension overview" on the home straight

The "Digital Pension Overview", which is already in the pilot phase and is to go live in December 2023, can be an important aid in this regard. It will list for each citizen individually the building blocks of statutory, occupational and private pension provision from which they can expect a pension in the future.

About the survey methodology: The data used is based on an online survey conducted by YouGov Deutschland GmbH on behalf of zinsbaustein, in which 2,026 people aged 18 and over took part between 13 and 15 December 2022. The results were weighted and are representative of the German population aged 18 and over.