Now that we are well on track across Europe in terms of environmental targets, which are now being pursued further, the social and governance targets are moving forward. One of the corporate goals in these areas is diversity, including gender diversity. Us Fondsfrauen wanted to know what the specific situation is with regard to gender diversity in the top levels of the asset managers who are active in Germany.

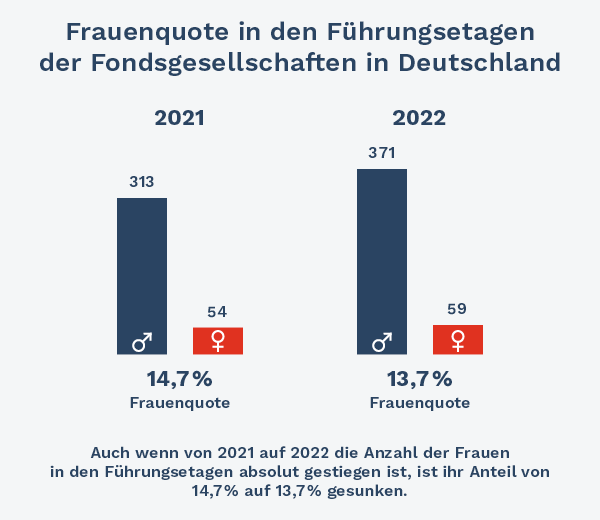

Quota of women in management positions down compared with last year

Daher haben wir, wie schon letztes Jahr, die Zusammensetzung der Geschäftsleitung in der deutschen Asset-Management-Branche untersucht. Die Frauen-Quote dort ist mit 13,7% erschreckend niedrig und ist gegenüber der Quote im vorigen Jahr sogar um einen Prozentpunkt (von 14,7%) gefallen.

Das ist insbesondere vor dem Hintergrund enttäuschend, dass viele Asset Manager das Problem von zu wenigen Frauen in der Top-Führungsebene erkannt haben und sagen, dass sie es angehen wollen. Am Ende des Tages werden die Posten dann aber offenbar doch überwiegend männlich besetzt. Dies zeigt, dass sich die Unternehmen schwertun, die Top-Führungspositionen mit Frauen zu besetzen. Unsere Schlussfolgerung: Entweder suchen die Unternehmen nicht richtig oder sie müssen mehr tun, um ihre Personal-Pipeline in Sachen Diversität besser auszubauen.

BVI now also has a woman on the Board of Management, Sonja Albers

However, we did see one ray of hope: The 7-member board of the industry association BVI now also has a woman on its top committee in Sonja Albers. Sonja Albers was appointed to the board of Union Investment on March 1 and then also quickly moved into the BVI board.

By way of comparison, the German Insurance Association (GDV), with 18 members, has a larger board than the BVI, which calls itself the "Presidium". Of the 18 members of the Presidium, three are female (Claudia Andersch from R+V, Katja de la Vina from Allianz LV, Monika Köslin from Kieler Rück).

Transparency increases

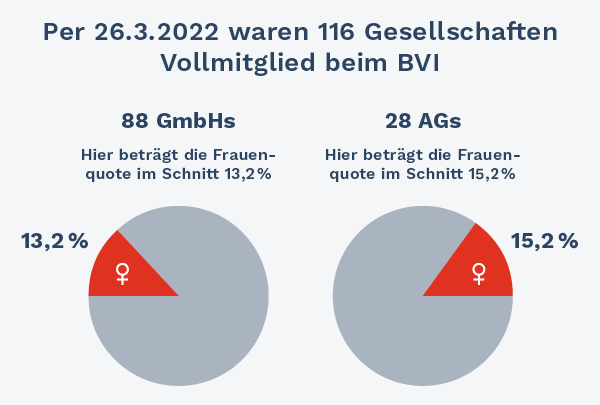

The data basis for our survey of fund company executives this year is all 116 companies that, as of the reporting date of March 26, 2022, were a Vollmitglied im BVI .

Depending on whether the asset manager is a GmbH (limited liability company) or an AG (stock corporation), there are usually several managing directors or board members. We have recorded all of them by name. This year, we were able to record the management level of 100% of the companies. In the previous year, on the other hand, it was not possible to find out the names of the management at four companies, either by searching the Internet or by asking several times. Transparency in this respect has therefore increased.

Among the 430 top executives, 59 are women

In total, there are 430 members in the top management bodies of the BVI full member companies, including 59 women, which corresponds to 13.7%.

The size of the top management boards varies between 9 and 1. The largest management boards with 9 persons each have

- LGIM Managers (Europe) Limited, Germany (Frauenanteil 44,4%)

- Munich Re Investment Partners GmbH (Frauenanteil 11,1%)

The following companies follow, each of whose management boards has 8 members.

- Universal-Investment-Gesellschaft mbH (Frauenanteil 12,5%)

- Vanguard Group (Ireland) Limited Frankfurt Branch (Frauenanteil 12,5%)

- Capital International Management Company Sàrl – Niederlassung Deutschland (Frauenanteil 0%)

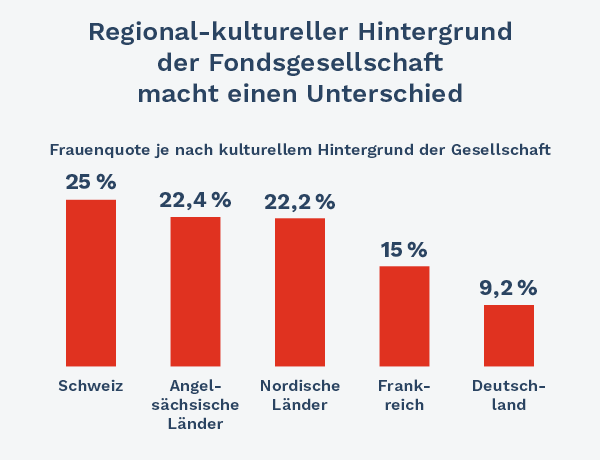

Companies with a foreign background tend to have a higher proportion of women

We suspected that fund companies with foreign roots might have a higher proportion of women because awareness of gender diversity is already more developed abroad. This suspicion was confirmed, at least in part. In particular, companies with Swiss (25%), Anglo-Saxon (22.4%) and Nordic (22.2%) backgrounds have a relatively high proportion of women in the 1st management level. By contrast, the average proportion at the purely German companies was only 9.2%.

Stock companies have a higher quota for women than limited liability companies

As in the previous year, we examined whether there are differences in the proportion of women between the legal forms. The majority of asset managers (75%) operate as limited liability companies. Among them, the proportion of women on the management board is 13.2%.

Around a quarter of the BVI full member companies operate as AGs. Among them, the proportion of female board members is somewhat higher, at 15.2%. One reason for the somewhat higher female quota could be that stock corporations see themselves in a stronger public light than limited liability companies and therefore pay more attention to visible governance rules.

No significant differences in the proportion of women between asset classes

Our initial assumption that the proportion of women was particularly high among real estate asset managers could not be confirmed this year either. Among pure real estate asset managers, the proportion of women was 12.0%, while among pure securities managers it was only slightly higher at 12.6%. However, it is striking that asset managers who also manage alternatives in addition to other asset classes have a relatively high proportion of women on their management floors, at 17.2%. This is probably due to the fact that there are relatively many companies with a Swiss or Anglo-Saxon background, which have a higher proportion of women.

This year we again want to draw attention to those companies that have a balanced proportion of women (40 percent or more) on their top management bodies. They are listed in the following table.

These BVI full member companies already have a particularly high proportion of women (over 40%) on their management boards.

| Company | Number of members of the Executive Board | Of which are women | Number of women in management |

| BNY Mellon Service Kapitalanlage-Gesellschaft mbH | 2 | 2 | 100% |

| Swiss Life Kapitalverwaltungsgesellschaft mbH | 2 | 2 | 100% |

| NN Investment Partners B.V., German Branch | 1 | 1 | 100% |

| Wellington Management Europe GmbH | 1 | 1 | 100% |

| BNP Paribas Real Estate Investment Management Germany GmbH | 3 | 2 | 66,7% |

| DWS Real Estate GmbH | 3 | 2 | 66,7% |

| Schroder Investment Mgmt. (Europe) S.A., German Branch | 5 | 3 | 60% |

| Allianz Global Investors GmbH | 6 | 3 | 50% |

| DWS Investment S.A. | 4 | 2 | 50% |

| GAM Luxembourg S.A. – Zweigniederlassung Deutschland | 4 | 2 | 50% |

| JPMorgan Asset Mgmt. (Europe) S.à r.l., Frankfurt Branch | 2 | 1 | 50% |

| Principal Real Estate Spezialfondsges. mbH | 2 | 1 | 50% |

| Robeco Deutschland | 2 | 1 | 50% |

| Savills Fund Management GmbH | 2 | 1 | 50% |

| Savills Fund Management Holding AG | 2 | 1 | 50% |

| Vanguard Group Europe GmbH | 2 | 1 | 50% |

| Warburg Invest AG | 2 | 1 | 50% |

| LGIM Managers (Europe) Limited, Germany | 9 | 4 | 44,4% |

| MFS Investment Mgmt. Company (LUX) S.à.r.l. | 7 | 3 | 42,9% |

Source: Survey conducted by Fondsfrauen, 2022

Apparently, a particularly high quota of women often goes hand in hand with a relatively small board. In the case of a board consisting of one or two persons, a single woman already leads to a women's quota of 50 or 100%.

Against this background, it is pleasing to note that Schroder Investment Management (Europe) S.A., German Branch has a disproportionately large number of women on its board (3 out of 5 board members), and Allianz Global Investors GmbH has a balanced gender ratio (3 women out of 6 board members). LGIM Managers (Europe) Limited, Germany also has a comparatively large number of women (4 women) with its relatively large management board (9 people).

We are continuing to work on this! Next year, we will repeat this survey and hope to find even more women on the top boards of asset managers active in Germany.