The shortage of skilled workers has long been noticeable in all sectors, including the financial sector. Where and how can you still look for good (female) professionals? Rita Pfahls from Indigo Headhunters has a tip that is surprising at first: "Asset managers and consultants should also look for professionals in the area of fund administration." When asked why, she has a clear answer: "There are professionals there who know the fund business very well from the inside. The people there have a mature skill set and know-how from administration to project management, to regulation, which can be well developed. The people there can do much more than book transactions, and they have a good understanding of the entire value chain of a fund!"

While asset management is seen as the engine in the fund industry, administration can be compared to gears. "The profiles in fund administration are often underestimated," regrets Pfahls. "Yet everything from regulatory knowledge to accounting, tax and investment law to risk management comes together there."

Versatile use possible

The development opportunities for employees in fund administration are considerable. It doesn't always have to be client support; positions in controlling, auditing, reporting, liquidity and risk management, in the legal area or in assisting with the structuring of instruments for institutional investors would also be a good fit," says Pfahls, listing some of the activities she considers suitable. She herself had her first job in fund accounting and then switched to sales and now works at the recruitment consultancy Indigo Headhunters. "I can think of many women who came from fund administration and are now pursuing careers in other areas of the financial sector," she explains.

Administrators are well connected

"Women, have the courage," she says to the predominantly female administration departments. Especially in administration, you are well networked: With other administrators, asset managers, with clients and external service providers, associations like the BVI and the regulator. Of course, a change in the previous company is also possible. "The contacts are there, because in administration you exchange information with almost all departments along the value chain," says Pfahls.

The 2020 Gender Diversity Study by Fund Women and KPMG shows that in the fund accounting departments of German asset managers, the female quota is 48%, which is only topped by the marketing (57%) and human resources (81%) departments. In contrast, the quota of women in the areas of portfolio management and sales is significantly lower at 21% and 25% respectively. So there is still a lot of potential for development!

Back and middle office roles should also be promoted and valued

Pfahls writes in the book for the companies to work for a good climate and to make an effort for ALL employees. How to do that? "Companies should value and develop their employees," says Pfahls. In-house marketing especially for the administration departments also requires more visibility in order to keep valuable colleagues in the company as long as possible. Especially in times of staff shortages, companies should strive for a good retention rate. "Every change of personnel is a considerable effort - from the search for the employees to their induction," explains Pfahls.

Particularly sought-after in the Rhine-Main region, Luxembourg and Poland

Especially in the Rhine-Main region, he says, it is challenging for companies in the financial sector to retain their employees because they have a particularly large number of opportunities there. "But Luxembourg and Poland are also hotly contested markets for financial professionals," observes Pfahls. Often, only a slightly higher salary is enough for a specialist to move to a company on the other side of the street.

She cites Universal-Investment as a positive example: "There, management, specialist and project careers are promoted. Positive performance incentives can also be set for internal roles in the administration area, for example when someone restructures work processes and makes them more efficient," Pfahls suggests. To make performance really worthwhile, she advocates measuring performance in all departments and providing bonuses for good performance.

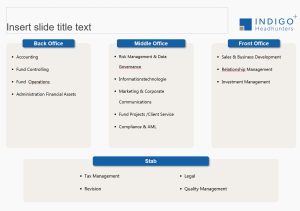

Here is an organisation chart showing the areas of responsibility in the front, middle and back offices:

Rita Pfahls: "Especially in administration you are well networked: With other administrators, asset managers, with clients, and external service providers, associations like the BVI and the regulator".