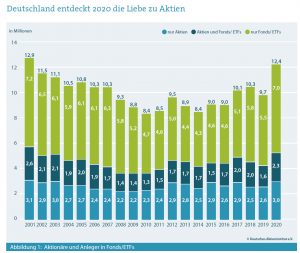

"2020 was a pleasing year for the stock culture in Germany," writes the Deutsche Aktieninstitut (DAI). Compared to 2019, around 2.7 million more people are now investing in equities, equity funds or stock-based ETFs.

Nearly 12.4 million citizens are directly or indirectly involved in the stock market. This means that about one in six people is invested in equities. This corresponds to 17.5% of the population aged 14 and over.

In the Corona year of 2020, almost as many people were involved in the stock market as last time around the turn of the millennium, when the dot-com wave caused a sensation. Particularly pleasing for our industry: Fund saving in particular is booming (see chart).

These are the results of a recent study by the DAI.

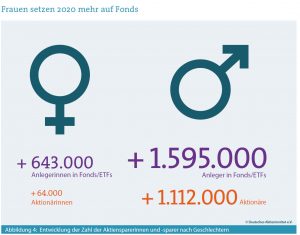

Women prefer equity funds, and less individual shares

What is striking, however, is that the enthusiasm for equities affects women significantly less than men. While more women have discovered investing in shares or equity funds in 2020, the increase for women is 650,000 new shareholders, while there are 2.1 million new male shareholders. The increase with men is thus three times that of women.

A close look at the gender comparison also shows a structural difference in investment: almost all of the growth in female investors is attributed to investments in widely spread funds/ETFs (see figure). On the other hand, the number of female shareholders, i.e. women who invest directly in individual shares, has remained more or less stable. The situation is different for investors. It is true that there is also an increase in the interest of men in saving with funds/ETFs. However, men have also gained more access to direct investment in equities: an increase of 1.1 million is recorded here.

But at least: the number of women with shares is growing, and that is a good development! After all, women in particular should become more involved in the stock market, as they receive on average less statutory pension than men in retirement and also live longer. An interesting Study ("The Gender Pension Gap in Germany") has been published by Niessen Ruenzi & Schneider in 2019, about which we have reported.

"With stocks or equity funds, you can ideally supplement your retirement savings," is the message we need to deliver. Especially in the long-lasting low-interest-rate environment, the higher yields that are beckoning on the stock market in the long run are helpful in building a sufficiently large cushion for old age.

Corona as a catalyst

But why are more people in Germany suddenly interested in equities? The DAI believes that Corona plays an important role in this: broken holidays, closed restaurants and less shopping in the inner cities have changed everyday life. "Many savers simply had more time and more money in 2020: time to deal with their own finances, and other money to invest in stocks, funds or ETFs," the DAI writes. Paired with the fall in stock prices in the spring, many apparently used this as an opportunity to enter the stock market.

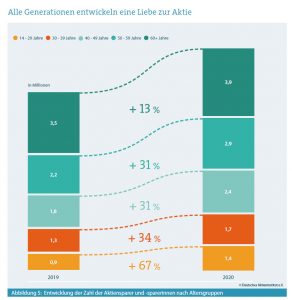

Young people discover stock investments for themselves

It is also pleasing that the generation of under-40s is also increasingly interested in saving shares: around one million new stock savers come from this age group alone. This represents an increase of almost 50%.

It should also be relevant here that the equity investment has now reached the pocket. Apps by low-cost brokers on smartphones make it easier for investors to get started in stock trading. With just a few clicks and small amounts, it is possible to save with funds, ETFs and stocks. Influencers and Internet forums have discovered the topic of investment for themselves and are reinforcing the trend with their communication on an equal footing. This especially appeals to the young generation, who find out about it and learn about discussions with like-minded people.