A global survey by BNY Mellon Investment Management found that women could invest more than $3 trillion. What's more, women want to invest where they can make a positive impact. Here are the three key findings from the study:

- Women would invest more if the investment had a clear purpose and positive impact on society and the environment.

- An additional $3.22 trillion in capital could be invested globally if women invested at the same rate as men (i.e., were both willing and able to do so).

- There are three main reasons that prevent women from investing. In addition, the report shows that the investment industry mainly targets men.

The survey called Pathway to Inclusive Investment is part of a new series of studies and deals with the topic of diversity. The study examined what prevents women from investing and the potential impact of removing these barriers. The study analyzed the responses of 8,000 participants from 16 markets and surveyed 100 asset managers with a total of nearly $60 trillion in assets under management.

The top three reasons that keep women from investing, according to the study, are as follows:

- The income threshold: On average, women worldwide think they would need about $4,092 per month or $50,000 per year in disposable income before they would invest any of it.

- Investments are fundamentally associated with high risk: Only 9% of women say they are willing to take a "high" or "very high" degree of risk when it comes to investments. By contrast, 49% describe their risk tolerance as "moderate" and 42% have a "low" risk appetite.

- Investment reluctance: Globally, only 28% of women feel good about investing some of their money. The industry needs to find ways to better engage and motivate women to invest, which in turn would lead to increased investment readiness and participation.

Women want to invest in companies with a positive impact on society and the environment

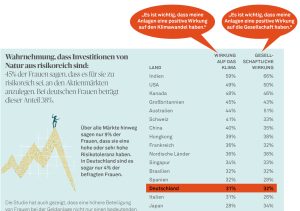

The survey revealed that for women, the return on investment is not the only decisive factor. They also want to make a positive impact on society and the environment. The implication is that if more women can be persuaded to invest, this could lead to increased inflows into funds with social or environmental objectives. More than half of women (55%) would invest - or invest more - if the impact of their investments aligned with their personal values. 53% would invest - or invest more - if the fund they were investing in clearly had a good cause.

This attitude is even more pronounced among young women. According to the survey, seven out of ten women under 30 (71%) who already invest prefer to invest in companies that support their personal values; among women over 50 who invest, the figure is 53%.

In Germany, we are comparatively far

BNY Mellon summarizes the specific findings for the German market as follows:

- 41% of the German women surveyed think they have a good understanding of investing. 15% say they are very familiar with the subject of investing. These values are among the highest among the markets covered by the study.

- In terms of the amount invested, female investors in Germany lead the field in an international comparison - the survey showed that on average they already invest just as much as men.

- However, 77% of the German women surveyed say they have never considered pursuing a career in the investment industry. The study also found that 40% of German women do not trust investment apps or online tools.

More inclusion would be good for the investment industry

The survey of asset managers, which was also part of the study, makes clear the extent to which the investment industry is geared towards men. Almost nine out of ten asset managers (86%) admitted that their default client - the person they automatically target with their products - is a man.

Almost three-quarters of the companies (73%) believe that the investment industry could succeed in getting more women to invest if there were more female fund managers, who could also serve as important identification figures. However, half of the asset managers participating in the survey said that only 10% or fewer of their fund managers or investment analysts were female.

BNY Mellon Investment Management wants to contribute to greater inclusion

Anne-Marie McConnon, Chief Client Experience Officer at BNY Mellon Investment Management, explains: "We are convinced that it is in all our interests to encourage more women to invest. Not only is it good for the future, but it's good for the economy and society in general. Pathway to Inclusive Investment shows that the traditional stereotype of the investor is outdated. Young women are definitely interested in investing, but they need to be motivated to do so."

As a firm that covers every area of the investment cycle, BNY Mellon Investment Management is uniquely positioned to make a difference, he said. "Through our partnership with the international charity Inspiring Girls, we want to create change at the grassroots level, introducing young women to money at an early age," McConnon said. "We will look at ways to motivate the approximately 25,000 women in our own organization to participate and invest more. We'll review our approach and consider how we can better engage women and work with intermediaries and the industry as a whole to effect change."